The Form I-9, Employment Eligibility Verification (I-9) is required by federal U.S. Citizenship law. Employers are required to verify each employee’s identity and eligibility to work in the United States at the time of hire.

The University of Texas at Austin utilizes Equifax, a secure, online tool to manage the I-9 process and comply with E-Verify requirements to verify an employee’s eligibility to work in the United States.

Who is required to complete an I-9?

Every paid employee of the University must complete the Form I-9. This includes:

- Newly hired faculty, staff, and student employees as well as casual and temporary workers who are paid by voucher or on a flat-rate basis.

- Anyone listed above who is rehired (who had a one-day or longer break in service) must complete a new I-9 Form. Completing supplement B for rehires will no longer be an acceptable process when using Equifax.

- Anyone in a 0% assignment before some form of payment (one-time payment, award, stipend, etc.) through UT Payroll is administered. If there is no record of I-9, payment will be held until compliance is met.

When is the I-9 completed?

- Both Section 1 and Section 2 must be completed within the specified time frame, this includes employees who have never been issued a Social Security Number. Employees who have never been issued a Social Security Number should apply for one and select 'SSN Applied For' to complete Section 1.

Section 1 is considered complete even if the SSN is pending. The form will not be sent to E-Verify until the SSN is provided, but this does NOT prevent completion of Section 2.

Section of Form I-9 Section 1 Section 2 Who Completes It Employee Employer* Deadline By the first day of work for pay Within 3 business days of the employee's first day of employment *Equifax is our Authorized Representative and completes Section 1 on behalf of the University of Texas at Austin.

- Section 1 of the Form I-9 can be completed after the offer is accepted. Employees will be required to provide certain biographical information.

- Section 2 of the Form I-9 can be completed after the employee completes Section I and must be completed within three business days of the first day of employment. Employees must show original, un-expired, valid government-issued documentation establishing their identity and eligibility to work in the United States in order to complete Section 2 of the Form I-9. A List of Acceptable Documents for the I-9 Process can be found here.

I-9 forms may be completed up to six months before an employee’s start date if the employee has successfully completed a background check and accepted a job offer. Any pending I-9 with an incomplete Section 1 or Section 2--including duplicate or canceled packets-will be purged from Equifax every 30 days.

How is the Form I-9 administered?

Hiring departments will have three location-specific Equifax Quick Start links. During Onboarding, I-9 Partners can either have Workday send the Virtual Equifax I-9 Anywhere Quick Start Link to employees or choose to send an Equifax Quick Start link themselves via email outside of Workday.

Location Quick Start links appear on the Additional Data Tab for I-9 Partners in the Dean/VP PM Supervisory Organization or by running the Equifax Locations, Emails, Users - RPT1197 in Workday. The table below lists three link types used to manage the Form I-9 Process.

| Link Type | Employee meets w/who and how | Who uploads Documents | When to use this link |

|---|---|---|---|

| Equifax In Person Quick Start Link | UT I-9 Partner at a designated location on campus | UT I-9 Partner** | Use for walk-ins, or when corrections need special attention. |

| Equifax Virtual with I-9 Partner Quick Start Link | UT I-9 Partner via laptop, desktop, or mobile device | Employee | Use when an employee is having issues using I-9 anywhere and/or corrections are needed, and in-person is not an option. |

| Equifax Virtual with EFX Agent Quick Start Link | Equifax Agent via laptop, desktop, or mobile device | Employee | Use for any new hire or rehire and when updating documents for supplement B* |

* Supplement B will only be used for Noncitizens Authorized to Work who have expiring documents.

** All documents uploaded to UT devices should not be retained and must be immediately deleted after uploading them to Equifax.

Equifax I-9 Anywhere dedicated call center for section two completion:

Virtual Completer Hours (English):

- Monday - Friday: 7 a.m. - 7 p.m. CT

- Saturday: 8:30 a.m. - 5 p.m. CT

Spanish Language Hours:

- Monday - Friday: 7 a.m. - 6 p.m. CT

What is the UT I-9 Partner’s Responsibilities?

- I-9 Partners must be assigned to the CSU Dean/VP Supervisory Organization to access Equifax I-9 Management. Equifax Login. For further details, please contact your HR Executive.

- I-9 Partners are responsible for ensuring employees receive the link to Equifax to begin their I-9 process, monitoring employee I-9 status in Equifax, and taking necessary actions such as reverifications, addressing pending SSNs, and photo-matching. Employees who do not follow the outlined I-9 regulations will be subject to termination.

- Notifications from Equifax will be directed to the CSU Location Email address. To view the CSU location information, I-9 Partners can run “Equifax Locations, Emails, Users – RPT1197".

Where does a UT I-9 Partner get support?

- Issue Reporting: I-9 Partners submit tickets on behalf of themselves and employees to Equifax Workforce Solutions Service team.

o Email: workforcesolutionssupport@equifax.com

o Phone: 877-664-8778

o Hours: Monday-Friday 7 a.m. to 7 p.m. Central Time

o Saturday: 8:30 a.m. to 5 p.m. Central Time

What are the penalties for Non-Compliance?

The United States Citizenship and Immigration Services (USCIS) agency enforces that employers have certain responsibilities under immigration law during the hiring process. Employers who violate the law may be subject to penalties and fines as explained on the (USCIS) website. In addition, non-compliance can result in the loss of federal contracts.

We all have a responsibility to assist the University in complying with our obligations under federal immigration and employment law. Any employee who fails to complete the I-9 verification process within the prescribed time limits must be terminated according to federal law.

Form I-9 FAQs

What do I do with I-9s that are still in process in Workday?

- Send one of the UT quick links for your location to the employee explaining the need to initiate a new I-9 in Equifax.

- Upon completion of section 2, add this comment: “Original I-9 was initiated in Workday; Section 1 was completed within required timeframe. New I-9 launched due to University moving to Equifax I-9 Management System on Oct. 13, 2025.”

- The HR Service Center team will cancel the I-9 Business Process in Workday once the employee has initiated their I-9 in Equifax.

How do I manage/monitor expiring work authorizations that live in Workday?

- Work Authorization Expiring Alerts have been disabled, and I-9 information will no longer be updated in Workday.

- Send one of the UT quick links for your location to the employee explaining the need to initiate a new I-9 in Equifax.

- Upon completion of section 2, add this comment: “New I-9 launched due to University moving to Equifax I-9 Management System on Oct. 13, 2025.”

- This will ensure that you receive alerts from Equifax when work authorizations are expiring.

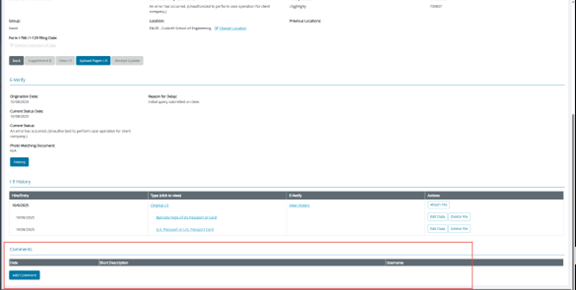

Where do I add comments to packets in the Equifax Management System?

How should an employee’s name be listed on Form I-9?

- Employees must use their legal name as it appears on their identity and work authorization documents when completing Section 1 of Form I-9.

Which citizenship status should an employee select?

- Choosing the correct citizenship status is critical. Mistakes can trigger E-Verify delays or kickbacks, requiring extra follow-up and risking compliance issues.

| Citizenship Type | Definition |

|---|---|

| U.S. Citizen | Born in the U.S. or its territories (e.g., Puerto Rico, Guam), or naturalized in the U.S. |

| Non-Citizen National | Born in U.S. outlying possessions (e.g., American Samoa), or born to non-citizen national parents |

| Lawful Permanent Resident (LPR) | Non-citizen authorized to live permanently in the U.S.; also known as a “green card” holder |

| Noncitizen Authorized to Work | Not a U.S. citizen, national, or LPR, but has legal authorization to work in the U.S.—often here on a visa (e.g., H-1B, F-1 OPT, J-1 etc.) or EAD Card |

Is a Social Security Number required?

Yes. Since UT is an E-Verify employer, employees must enter their Social Security Number (SSN) in Section 1 of the Form I-9.

If an employee has never been issued an SSN:

- The employee must apply for a Social Security Number before completing Section 1.

Apply here: https://www.ssa.gov/ssnumber/

- Proof of initiating this process (SSA receipt) must be validated by the department.

- In Section 1, the employee should select “SSN Applied For” and complete.

Section 1 is considered complete even if the SSN is pending. The form will not be sent to E-Verify until the SSN is provided, but this does NOT prevent completion of Section 2.

Updating an SSN on the Form I-9

- The SSN must be updated in Section 1 as soon as the employee receives it.

- There are two ways to update an SSN on the Form I-9:

- The I-9 Partner manually enters the SSN in I-9 Management, or

- The I-9 Partner sends an email through I-9 Management for the employee to enter the SSN.

Once Section 1 is updated, the I-9 Partner must submit the Form I-9 to E-Verify by selecting “Send to E-Verify.”

How does an employee apply for a Social Security Number?

- Click here for information on applying for a Social Security Number.

Is a photo ID Required for everyone?

- Yes. Since UT is an E-Verify employer, the employee is required to provide a list B document that contains a photo if using Lists B & C for verification OR a photo document from list A for verification. Click here to view a list of acceptable documents.

Who Can Complete Section 1?

- The employee is responsible for completing Section 1. They may use a translator if they do not understand enough English to complete it. However, the translator must complete the Preparer and/or Translator Certification block. The employee must still sign the certification block in Section 1.

What is the process in Workday now that we are using Equifax?

- Beginning October 13, 2025 the Form I-9 Process in Workday will be replaced with a “To Do” task for the I-9 Partner to send the employee their Equifax location link to complete their Form I-9.

- For Hires and Rehires, the I-9 Partner will have the option to send the Virtual Equifax I-9 Anywhere Quick Start Link via Workday, which automatically populates Section 1, or to send a link via email outside of Workday.

- The I-9 Partner assigned to the employee’s position supervisory organization will be responsible for completing the “To Do”.

What happens if the Form I-9 cannot be completed?

- Employees who are unable to meet federal Form I-9 requirements cannot lawfully be employed. Also see “What are the penalties for non-compliance?” above.

What if a student worker doesn't complete their I-9?

If a student employee misses the deadline for completing Section 1(end of 1st day of work) or Section 2 (within three business days of the 1st day of work), they must immediately cease work for noncompliance.

A notification to the student should include the Supervisor and HR Business Process Initiator via CC to ensure visibility and prompt action.

The student’s current position must be terminated to eliminate ambiguity regarding employment status.

Absence Partner or Timekeeper should ensure all hours worked are up to date on their timesheet for final payment.

CSU’s should allow the student to be rehired for the same position when Form I-9 is completed. A new hire process will need to be initiated, with a new start date determined by when the student becomes compliant.

Terminating the student’s employment while they are out of compliance is a necessary measure and will allow them time to present the required documents. Please ensure that you are providing guidance regarding documentation as outlined on the I-9 form. Once they are able to complete their I-9, student should be rehired into their original position.

How will terminations be recorded in Equifax?

- Termination dates will be populated in Equifax through a centrally managed integration upload process and will not be the responsibility of I-9 partners.

E-Verify FAQs

What is E-Verify?

- E-Verify is a free web-based service that electronically verifies the employment eligibility of newly hired employees and existing employees assigned to work on a qualifying federal contract. E-Verify compares information from an employee’s I-9 to U.S. Department of Homeland Security and Social Security Administration records to confirm employment eligibility.

- As a federal contractor, UT is required to use the E-Verify system to verify employment eligibility of employees working in the United States on assignments paid by a federal contract that includes the Federal Acquisition Regulation (FAR) E-Verify Clause.

Why do we use E-Verify?

- Texas requires state agencies, public colleges, and their contractors to use E-Verify. E-Verify is used to reduce unauthorized employment and to minimize verification related discrimination.

What if an Employee receives a TNC- Tentative Non-Confirmation (Mismatch)?

A Tentative Non-Confirmation (TNC) means the information entered in E-Verify from the Form I-9 doesn’t match records from the Department of Homeland Security (DHS) and/or Social Security Administration (SSA). This does not necessarily mean the employee is not authorized to work in the U.S.

The employee must be notified of the mismatch, which may come from DHS, SSA, or both.

IMPORTANT

Employers may not terminate, suspend, delay training, withhold or lower pay, or take any other adverse action against an employee because of the mismatch, until the mismatch becomes a Final Nonconfirmation. If the employee chooses not to take action on the mismatch, the employer may terminate employment with no civil or criminal liability as noted in "Responsibilities of the Employer," Article II, Section A paragraph 13 of the MOU. The case can be treated as a Final Nonconfirmation and the employer should close the case in E-Verify.

What if an employee receives a Final Non-Confirmation?

A Final Non-Confirmation (FNC) occurs when E-Verify cannot confirm an employee’s work eligibility because:

- The employee contacted DHS or SSA, but the issue was not resolved;

- The employee did not contact DHS or SSA within 8 federal working days;

- The employee did not inform the employer of their decision to take action within 10 federal working days.

Employers must close the case after an FNC result and may terminate employment without liability, as outlined in the MOU.

I-9 Partner Resources

- List of Acceptable Documents

- UT Equifax Training Video

- Connections I-9 Management (create an account with first name, last name, and email, this is available to anyone)

- Form I-9 Compliance Regulations Overview

- I-9 Management Support Guide (self-paced interactive)

- I-9 Anywhere Virtual Completion (self-paced interactive)

- I-9 Anywhere Supplement B (self-paced interactive)

- E-Verify Participation Poster

- Submission Form I-9 Questions with Answers (PDF)

- Workday Personal Equifax I9 Filters Guide (PDF)

Employee Resources

On This Page

Equifax Login

Access requires that you must have an I-9 Partner role assigned at the top level of the CSU Dean/VP Supervisory Org. If you receive a login error, please contact your HR Executive for Workday security role assistance.

Contact Info

Human Resource Service Center

HR Portal

512-471-4772 (HRSC)